The Financial Burden of Raising a Millennial

How Adult Children are Indirectly Stealing from their Parent's Retirement Savings

Millennials have arguably faced more major economic turmoil in their twenties and thirties than any previous generation since the Great Depression.

First, there was the Great Recession that crushed the housing market back in 2008 and led to a complete banking collapse. Then, there was a once every century global “pandemic” that brought the entire economy and financial markets to a complete standstill in 2020. Combine these with crippling student loan debt, record home prices, and 40-year high inflation attributing to negative real wage growth, and you have a recipe for a cohort of financially struggling adults drowning in debt who are barely able to get by.

So, who do they turn to for help? Many rely on assistance from the government, but nearly all will first seek help much closer to home…their parents.

Ruining Their Parents Retirement

A recent study revealed that a growing number of parents are putting their own retirement at risk to support their adult children. Shocking numbers reveal that 68% of parents are currently providing financial support to their adult children with many sacrificing their own retirement savings to do so.

Providing financial aid at the expense of your own security is analogous to neglecting to secure your own oxygen mask first. If you run out of oxygen, then you can’t help anyone else.

The concerning part is that many of these parents are acquiring significant amounts of debt to help their children. Over 25% of parents are assuming credit card debt, and 22% are taking out personal loans to support their adult children financially.

The vast majority of millennials, accounting for 78%, have benefited from some form of financial assistance from their families, ranging from funding college education to making down payments on homes and cars, as well as receiving inheritances, with a remarkable 27% receiving a minimum of $25,000 in financial support. Keep in mind, this does not account for the savings boost that many have benefited from by living with their parents.

The numbers become even more alarming when you know the retirement statistics. The Schroders 2023 Retirement Survey found the average working American aged 45+ believe it will take at least $1.1 million saved to retire comfortably. This isn’t even remotely close to the $250,000 in savings the average American has socked away for retirement by the age of 65 years old.

A $1.1 million nest egg plus social security would allow the average person making $65,000 per year to get by “comfortably” while someone taking home $120,000 annually during their working years would need a nest egg value closer to $2.5 million. Fidelity Investments, the largest 401(k) provider in the country, revealed in a recent study that only 1.4% of 401(k) account holders had over $1 million.

It's clear that parents are facing a difficult choice between supporting their children and securing their own financial futures. While it's understandable that parents want to help their children succeed, sacrificing their own retirement savings isn’t the answer. Parents need to prioritize their own financial well-being to avoid becoming a financial burden on their children in the future.

One possible solution is to have open and honest conversations with adult children about money management. Encouraging them to take responsibility for their own finances and providing them with the tools and resources they need so they can alleviate the strain they are placing on their parents.

“Open and honest conversation” looks like an easy solution on paper, but money tends to be a taboo topic in many households. The greatest fear for any parent is being ostracized by their adult child because they did not come to their aid. Plus, no loving parent wants to witness their child struggle through life even it means foregoing their own financial future.

There’s also the fact that not all advice is good advice. Unfortunately, many parents don’t have the best financial education and simply lack the ability to provide sound advice to their children which in turn creates a larger generational wealth gap from financially literate families.

The financial challenges facing parents who are sacrificing their own retirement for their children are a significant concern, but parents must prioritize their own financial well-being and retirement savings. By doing so, we can ensure that both parents and children are on the path to financial stability and a secure future.

The TLDR

Parents: put on your own mask first or you’ll end up being the burden to your children.

Adult Children: if you rely on your parents for financial support today, then be prepared to support your parents financially tomorrow.

Generational Financial Freedom

When I was 16 years old my parents opened up a Roth IRA for me. To this day, I credit my father for creating the single best financial foundation I could have asked for.

Of course, I didn’t know it at the time, but rather than spend money buying me frivolous things I really didn’t need or would later outgrow, he instead put money into my account every year. This lesson taught me the power of compound interest and the importance of paying myself first from a very young age.

I maintained that Roth IRA for 18 years and it grew to be over six figures in value. With it, I not only had the launching pad Kindra and I used to kick start our MPI policies, but also the habit to save aggressively for our future family.

That habit is instilled in me and why we are passing it down to our next generation.

Christmas 2022: My dad, my baby boy, and me in my parent’s dream house they had built in retirement.

When our son, Kastle, was born we started an MPI Children’s policy for him immediately. Just like my father did for me, I am now dedicated to ensuring my boy’s financial foundation is set so he can go through life with even greater opportunity.

I believe most parents strive to see their children succeed and achieve greater success than they themselves accomplished in their life. This is why it’s painful to see them struggle. Buying your kids nice things feels good, but the single greatest gift you can give them is financial literacy and the power of secure compound interest that will last their lifetime.

Don’t wait until your kids are grown. Once you have your own financial house in order, start an MPI Children’s Policy so they have their financial foundation set and don’t have to rely on you to support them when their 30.

Unlike the Roth IRA or 529 College Savings Plan, the MPI Children’s Policy provides them the ability to use their money at any age for any reason without penalty and ultimately achieve financial freedom on their own terms.

Share this newsletter with other parents you believe could benefit from starting an MPI Children’s Policy for their kids.

What’s Your Comfort Level?

The majority of people and businesses have been affected by inflation, which has caused prices to rise and made it more challenging for Americans to achieve “financial comfort”.

The definition of financial comfort varies depending on the individual's situation. For example, some individuals may define financial comfort as having enough funds to retire, while others may define it as paying off debt or meeting rent obligations on time.

According to CNBC's Financial Confidence Survey, 20% of Americans stated that they would require $1 million to feel financially comfortable, while almost 75% said they need $100,000 or more.

$10,000: 8%

$25,000: 14%

$100,000: 36%

$500,000: 18%

$1 million: 20%

No answer: 4%

Although inflation has shown signs of slowing down, the target rate remains considerably higher than average levels. Numerous indicators suggest that Americans are struggling to cope with the rising costs associated with inflation.

CPI on the Decline

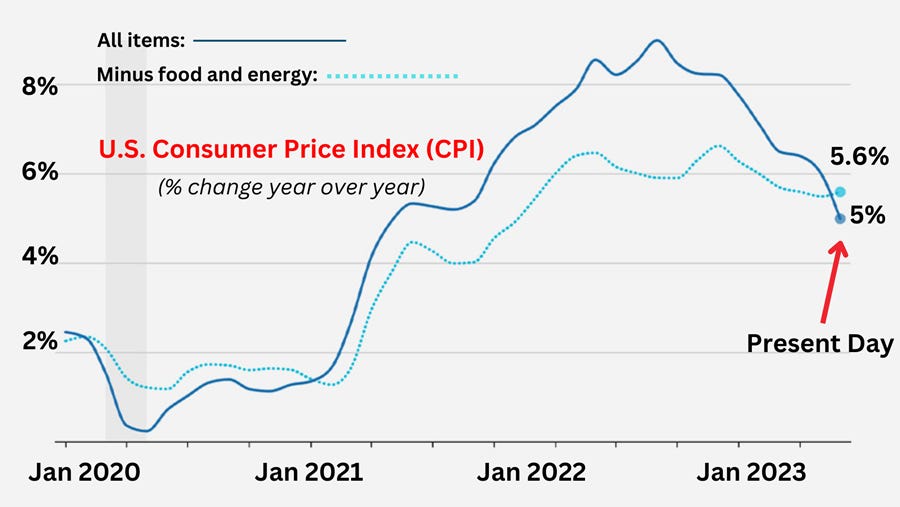

Speaking of inflation, the Consumer Price Index (CPI) was released last week.

Image via Market Briefs issue 4/13/2023 - data via U.S. Bureau of Labor Statistics

According to the report, inflation in the United States has declined to its lowest level since May 2021. For the ninth consecutive month, annual inflation, as measured by the Consumer Price Index, has decreased.

Despite inflation remaining significantly above the Federal Reserve's target of 2%, data from last month indicates that it is showing signs of decelerating. Additionally, overall food prices have eased up for the first time since 2020.

Don’t get your hopes up: Although price growth is slowing down, experts anticipate that it will not entirely reverse, and inflation will likely persist, resulting in continued financial difficulties for consumers.

MPI Webinar

Do your friends and loved ones deserve MORE MONEY FOR THEIR FUTURE?

They do! Let CEO & Founder Curtis Ray show them a better way on his LIVE webinar, "Intro to MPI® Premium Strategies: Financial Awareness for All”.

Empower them with the same Features & Benefits of Premium Life Insurance you already get.

On this webinar they will:

- Learn how to get up to 3x More Retirement Income

- How to Avoid the Volatility of the Market

- How to Retire Early, Tax-Free

- How to Leverage the Power of Compound Interest like the rich

- How to Build and Keep Generational Wealth

- More Money for Their Future, Their Family, Their Retirement, and Their Heirs

Don't let them miss the LIVE Q&A and Giveaways.

Have them join us Wednesday, Apr 19th, @ 08:00 PM Eastern Time

We look forward to having them there!

Thanks For Reading!

It takes me hours to research and compile this information for you in a distilled way that I hope brings you value. I really appreciate you taking the time to read it.

If you did find value in it, smash that heart button to help others find this newsletter and hit that subscribe button if you haven’t already done so!

Life is hard right now 100% but I also feel like many adult kids are expecting to not have responsibility and then parents are enabling those decisions. That's why I'm trying to educate my kids now and hopefully once they are adults they will have the skills and back on to not be a Burdon on society.

I also intend in creating generational wealth and also the knowledge to make sure it keeps on growing for generations to come.

Your Fasha is The Man!